Most customers are well aware that incoming QC inspection (IQC) is one of the most important “quality gates”. Ensure the components and semi-assemblies are acceptable before proceeding with final assembly, because finding widespread issues after IQC is a very expensive problem.

However, some customers don’t see the value in incoming QC and ask if it can be skipped in an effort to save money. The problem is, skipping IQC is akin to buying a second-hand truck without even looking under the hood — saving a few hours of work but then being exposed to a loss of tens of thousands of dollars. Let us explain why…

Why not trust the component suppliers?

With a perfect supply chain, there is no need for inspections.

For instance, some of Toyota’s suppliers have been known to deliver more than 1 million parts without a single defect… However, those are the best manufacturers in the world, and a lot of engineering work went into developing the parts in question so they are not likely to be defective.

And when quality issues are detected in an automotive factory, it triggers enormous costs. In some cases, it shuts down the entire production line, which costs more than 50,000 USD per minute. There are real costs involved.

Now, what about you? Do you purchase high volumes of mature components from world-class manufacturers? Or do you buy from companies that routinely have between 2 and 5% defective units per batch, and are from time to time forced to re-work or re-produce an entire batch that got messed up?

That is the world most companies that buy components from China live in. That is probably your world, too.

In electronics, it is definitely the norm. Even Apple feels the need to monitor everything very closely (they have more than 10,000 people in China to monitor developments & productions).

Good supplier qualification helps

Of course, with good sourcing, the quality risk goes down.

As a minimum baseline, here at Agilian, we want suppliers to commit at least to the following:

- Accept our purchasing agreement, which provides us with leverage if they deliver a bad product

- Perform outgoing quality control of their parts before they send them to us

- Use proper packing and labelling, to prevent damage in transit and to reduce the risk of shipping the wrong quantity

- Display a good attitude and communication in general

However, there are severe limitations to this approach:

- When we can’t go beyond that “minimum baseline”, we have to reject a lot of batches of components

- Some of our customers have selected some suppliers, and there are high switching costs, so we have to accept a high level of uncertainty

- Some of our customers’ orders are relatively small for China, and getting a good supplier interested can be nearly impossible

Incoming quality routinely impacts our productions

As I wrote above, if one does NOT purchase mature components from world-class manufacturers, the odds of receiving bad quality are high.

How high? Based on our internal data, in such cases, 10 to 15% of the batches are considered ‘failed’ at the incoming QC stage.

Does that sound high, and is it alarming? Yes, and yes!

But it gets worse.

For a product that requires 50 components, including 10 custom-designed components, the odds are very much stacked against receiving “all good components the first time” in the first few production batches. In most batches, at least 1 component will be rejected…

Experienced manufacturers put most of their quality control resources on Incoming QC

I had a look at classic quality literature, and it comes out quite clearly, as soon as one steps outside of the automotive and aerospace industries.

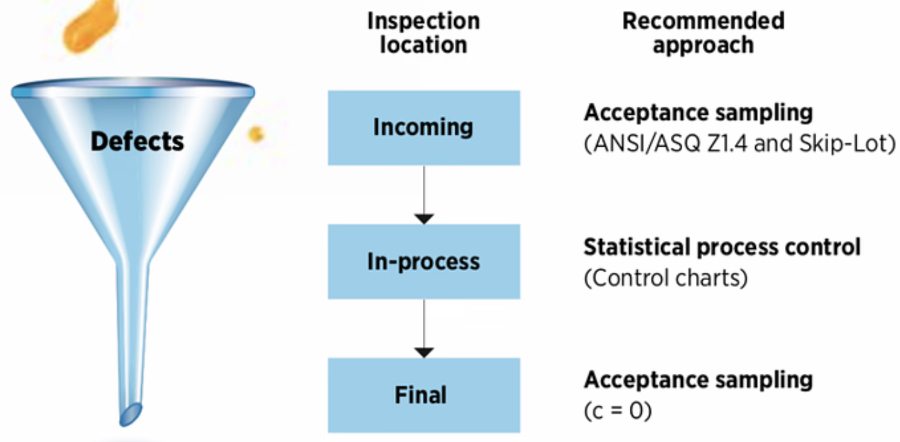

Let’s take this good article that was published in the American Society for Quality’s monthly magazine in 2018. The author shows the 3 elementary quality gates in a production system:

Look at the shape of the funnel. Clearly, most of the defects are “caught” and segregated at the incoming QC stage.

It makes sense to apply random inspections on the batches of deliveries from suppliers. It calls for a group of inspectors.

After that, the author suggests in-process QC based on statistical tools as much as possible — this is often managed by the production staff.

The key is to manage the process, not really to check products.

For final QC the author suggests an “acceptance on zero” sampling plan, which allows for much faster inspections.

In other words, most of the inspection work is done at the incoming stage.

What are the possible consequences of skipping incoming QC? (Scenarios)

Let’s go through several scenarios:

a) 100% of the components are made consistently to the expected standard, for 100% of the components.

This is great! Unfortunately, as I wrote above, it is not the norm if you are not working with world-class suppliers.

More likely, one of the following scenarios will occur.

b) Packaging issues are noticed by the warehouse personnel.

If the outer packaging is damaged or wet, the warehouse staff is likely to detect it and let the project manager know. However, there is no clear path forward. Someone needs to look at the components. Have some boxes been stolen? Is there an impact on quality, for example, if some parts get wet?

c) Quality issues are noticed by the production staff.

Let’s say two metal parts don’t fit well:

- Assembly workers might lose a lot of time (by applying more force, by trying to fit different parts together…). All that extra time is money…

- Some of the parts will be put aside. They don’t fit. But at this stage, there is no analysis of ‘why?’. They can’t be sent back to the supplier if there is no determination that their dimensions are out of tolerance. That analysis takes time. And, if the supplier doesn’t want to take the parts back, it can be quite a loss.

d) Quality issues are noticed after some/all production operations.

Let’s say the plastic enclosure is welded ultrasonically on the first 1,000 units, and then someone in production notices a defect on some of those enclosures. It is severe, let’s say it affects the waterproofness of the product.

It is not clear how many of the already-welded enclosures have that defect. Checking those first 1,000 finished units, and checking the remainder of the enclosures, can take a long time.

After some inspection work, it becomes clear that 40% of the enclosures have that issue. The production is put on hold for the time of that inspection, and then it can’t keep going. The labor efficiency on that line is much lower, which translates into extra costs. The production stoppage also throws off the daily production plan, which makes the whole system less efficient.

A lot of the units already assembled cannot be disassembled at all because of the welding. They have to be cut open, the internal parts have to be taken out carefully (and some of them will be damaged, calling for more scrap), meanwhile, a new batch of enclosures has to be ordered (with negotiations so the supplier takes responsibility), and so on. This is overall quite costly.

e) Quantity issues are noticed after some/all production operations are done.

Let’s say a very specific type of screw is used for this production. And, by mistake, only 70% of the order quantity was delivered. This is going to be discovered by production, which will have to stop early. More screws need to be ordered and delivered, and the production setup will have to be done a second time. This represents extra hours of work + lower productivity, and it throws off the daily production plan.

f) Quality issues are noticed in the outgoing QC inspection

Some of the issues on components may not be detected at all during production. (Remember, production operators focus on doing their job consistently well and within the allotted cycle time, they are not inspectors.) Some of the issues also make it through in-process QC inspections, which are only done on some samples picked at random.

If those issues are caught after all the production is over by the outgoing QC inspectors (in other words, by the ‘last line of defense’), it may lead to a LOT of work.

In some cases, it involves re-opening all the boxes, checking & sorting all the products, analyzing the situation and discussing with the customer and with the suppliers, reworking some products, scrapping & re-producing others, etc. That’s quite costly in terms of time and material.

g) Quality issues are noticed after delivery

This is the worst scenario. It can lead to bad reviews, chargebacks, order cancellations, heavy penalties, lawsuits, and sometimes even a total product recall (remember the Mattel toys that had lead paint?).

I think one can safely conclude that, in the vast majority of cases, incoming QC really is a must.

What happens during incoming QC?

As I wrote above, incoming QC is usually done on a random selection of components from each supplier delivery. (More time is naturally devoted to CTQ components, which sometimes need to be checked one by one.)

What if an inspector finds an issue?

The non-conformance reports have to be reviewed by the team that follows the product, as it may be a serious issue or a very benign one.

A good practice that is worth mentioning is the material review board (MRB). People from different functional specialities have to give their analysis/opinion. And, when appropriate, the customer is asked for a decision.

We wrote before about the typical decisions that come out of this process:

- Use-As-Is. If the issues are found to have either no or a low incidence on quality the incoming batch may be accepted. An exception may be requested from the customer(s). The engineers and the manufacturing people on the board should be able to suggest if the materials are able to be used as is without negative effects.

- Rework/RTV/Scrap. If the issues are severe and affect the vast majority of the pieces, the decision is usually to send the material back to the supplier (or to request the supplier to send a team to rework on-site), or to scrap it. Rework can be preferable to scrapping materials and the purchasing reps and engineers can decide if the value and time required to do the rework make it a worthwhile task.

If not, returning defective materials to the vendor can be effective financially if it’s clear that they are not acceptable (such as non-functional PCBAs that were supposed to have been tested).

The last resort is scrap. The MRB will examine what went wrong and calculate the costs of the scrap. Over time the answers will give them a view of where the most scrap is generated from and its costs. This may influence future purchasing decisions and guidance given to the supplier in order to reduce scrap. - Perform 100% inspection and sort. If the issues are severe but only affect 3-20% of the products, 100% of the materials can be inspected by the quality inspectors or (more likely) by production operators at the start of the line. Bad products are sorted out (and then the above decision to rework, RTV, or scrap is made*), with the remaining good ones used in production.

Get help

If you have any questions about incoming QC or anything else quality and manufacturing-related, please get in touch with us and we’ll be happy to listen to your situation, give you advice on how to proceed, and let you know how we can assist you.